Days are gone when you have to wait in long bank lines on pay days or worry about misplacing the paper checks. With direct deposit, your paychecks are automatically, securely, and on time deposited directly into your bank account. This modern payment method is commonly used by businesses to facilitate transactions for paying their employees.

More than just convenience, direct deposits help you manage your money efficiently, save your time, and allow automatic bill payments. From improved security to quick access to funds, it is no wonder that 94% of employees rely on this advanced system. If you are still confused as to why so many people prefer this payment option, keep reading and learn the advantages of direct deposit in detail here!

Direct deposit works through the Automated Clearing House (ACH) network. This system facilitates the automatic, faster, and secure transfer of all payments from the employer's bank to your account. Till now, you know what a direct deposit account is. Let's now understand how it works:

The following are the impressive benefits of using direct deposit:

Direct deposit makes the transaction easier and reduces the number of bank visits for both the financier and the recipient. The money is transferred on payday (even if the bank is closed) quickly and can be used immediately. In the case of a paper check, you have to visit the bank and wait for the money to be cleared before it is available for use. Not only that, but this electronic version also allows you to easily pay bills, transfer money, and efficiently manage all your finances. Indeed, it has made life easier and saves time, which can be used to complete other tasks, such as making a budget plan.

Regardless of how careful you are, there is always a risk of losing, damaging, or misplacing the paper check. Consequently, you will have to wait until the employer stops the payment and issues you another check. Aside from that, any other person can cash your check as it only requires a signature. It usually occurs when a bank employee fails to verify the identity of the person cashing the check. You will have to wait and put in the effort to prove this theft until you get paid again. While direct deposit eliminates the need to handle checks carefully, your money cannot be stolen, unlike with a physical check.

Digital banking is here to stay, and fortunately, direct deposits are also a crucial part of this convenient banking system. If you also want to be a part of this system, you need to set up a direct deposit. To complete this process, you will need to fill out a form and provide basic information, including your name, address, bank routing number, and account number. The bank routing number is the first set of numbers located at the bottom left side of a check. Your account number will be printed at the bottom right side of your check.

When your salary comes into your account on time, you will never have to stress about having funds available to pay the bills. You can even schedule rent, bills, and other payments to be deducted as soon as your pay is deposited into your account. It helps you budget, pay all your dues on time, and avoid late fees. Ultimately, you can achieve your financial goals more quickly. To save money, consider splitting your paychecks into multiple accounts. For example, a small amount of money can be saved in a travel account, an emergency savings account, or a down payment account. The good part is that you will not have to remember to transfer the money if you follow the old savings rule, "pay yourself first".

With direct deposit, managing your accounts is easy and convenient. You don’t need to keep a record of your money. Your money is deposited into the account, and all the information is recorded automatically. In this way, you can get a detailed and organized transaction history. It can help you monitor expenses, track your income, and plan for the future. So, why not say goodbye to paper checks? Moreover, when you pay the tax, it will be incredibly beneficial to have a digital record of all transactions.

Many financial institutions also offer special benefits to customers who use direct deposit. These perks include waived fees and access to premium services, as well as higher interest rates on savings accounts. Not only that, but direct deposit is usually free for the customers. By taking advantage of direct deposit, you can also enjoy these perks and save money. Wouldn't you like to earn money without putting in extra effort?

The following are the possible disadvantages of direct deposit:

In this fast-paced world, security and convenience matter most, and this is what a direct deposit offers you. Not only that, but direct deposit saves valuable time, provides quick access to funds, and helps you make a budget. You can also enjoy other perks, such as waived fees and higher interest rates. So, what do you want more?

TOP

TOP

Discover the key differences between Pilates and Yoga to choose the best path for your wellness.

TOP

TOP

Learn the hidden risks of silent heart disease and how to protect your heart health.

TOP

TOP

Optimize cycling comfort and performance with expert foot care and proper shoe choices.

TOP

TOP

Discover the top 5 travel goals to achieve in 2025 and ignite your wanderlust with must-visit destinations and unforgettable experiences worldwide.

TOP

TOP

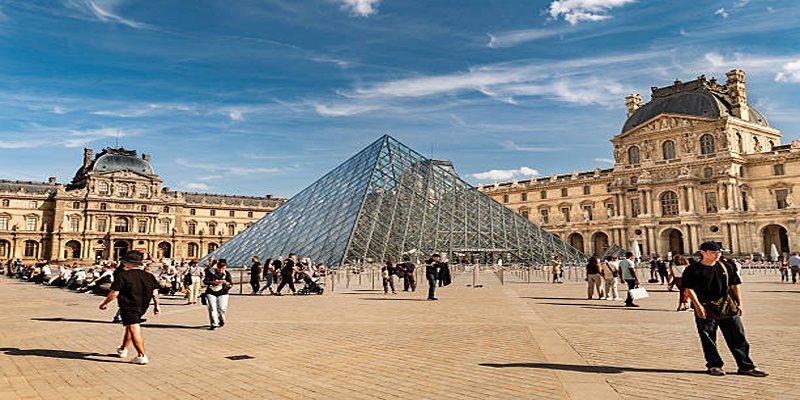

Discover Paris beyond the usual landmarks with unique attractions and hidden gems that reveal the city's authentic charm.

TOP

TOP

Oman’s Grand Canyon, a breathtaking destination offering stunning views, cultural insights, and adventurous hiking trails.

TOP

TOP

How Macumba blends ancient traditions and innovation at La Route du Rock, offering transformative musical experiences that unite and inspire.

TOP

TOP

Learn key facts about pediatric craniofacial surgery, common conditions, procedures, recovery, and emotional support that improve children’s health outcomes.

TOP

TOP

Explore how eczema increases the risk of asthma and allergies, key risk factors, immune dysfunction, and management strategies for better health.

TOP

TOP

Oman’s breathtaking coastal hiking trails, blending stunning nature and rich culture. Plan your perfect adventure today!

TOP

TOP

Learn what a promissory note in real estate is, how it works, its importance, and how it differs from a mortgage in detail here

TOP

TOP

Discover how hormones affect acne, dryness, and skin health, and learn practical tips to restore balance naturally.