Investigate nearby markets by reviewing recent rents, occupancy rates, sales trends, and local amenities. Before purchasing, estimate cash flow by subtracting conservative rent projections from realistic operating expenses. Compare mortgage options and obtain pre-approval to understand borrowing costs and strengthen your offers. Set aside funds for repairs, insurance, taxes, utilities, property management, and reserves to cover vacancies and unexpected emergencies.

Select property types that align with objectives by weighing maintenance and appreciation against cash flow prospects. Secure an experienced property manager along with a qualified real estate agent, home inspector, lender, and accountant to guide your investment. Search carefully for underlying problems, correctly estimate repair costs, and renegotiate when suitable professionally. Regularly screening tenants helps lower risk through credit checks, rental history verification, income verification, and reference checks.

Begin by examining the neighborhood's rent ranges, crime statistics, educational institutions, transportation options, and employment hubs. To understand appreciation patterns over the past few years, examine current similar sales. Before making offers or renewals, assess local regulations, rent control laws, and licensing requirements to determine tenant demand and seasonal fluctuations by monitoring vacancy rates and landlord incentives.

Develop a weighted score for property desirability objectively by mapping neighboring amenities. Discover off-market opportunities and verify information by utilizing local brokers and online resources. Compare actual expected returns across properties by calculating rent-to-price ratios and cap rates. Consider development initiatives and zoning modifications that may impact rents and property values. Attend open houses, network with local investors, and monitor the time-on-market for listings, findings in a brief investment memo to direct long-term planning and offers.

Over time, prioritize properties with a solid geographic basis and consistent tenant demand. Run conservative pro forma models for vacancies, management, maintenance, and capital expenditures. Before settling on offer pricing and terms, assess the repair requirements and obtain quotes from contractors. Inspect the state of structural, roofing, HVAC, and key systems to avoid unexpected maintenance costs. Calculate the worth following restoration and conduct sensitivity analysis with rent and expense scenarios.

Verify utility arrangements, meter separations, and unit conversion options that may impact revenue streams. Verify insurance costs for buildings in high-risk regions or floodplains nearby. Run monthly local rental comps to verify rent predictions before making strong offers. Evaluate the potential for value-added benefits from cosmetic renovations or upgrades to raise rents. Balance cash flow and appreciation targets while selecting among income and growth opportunities.

Order a professional inspection early to uncover hidden structural issues and safety risks. Acquire reports on pests, sewer scoping, and environment if the age of the property raises appropriate doubts. Check title, easements, property lines, and any outstanding code infractions that might limit ownership. Gather tax history and utility bills to validate operating expense baselines and responsibilities. Ensure planned rentals and tenant types are guaranteed by verifying permitted uses and zoning compliance.

When inspection uncovers major flaws, negotiate seller disclosures and demand repairs or credits. For operating statements and lease copies, request verification of rents and tenant responsibilities. Check accessibility for inspections and complete post-offer due diligence tasks. Clearly specify conditions in writing and safeguard earnest money by escrow instructions. Before settling, funds are released, and a final walkthrough is conducted to ensure the condition and confirm any necessary fixes.

Support offer price and defend negotiating positions boldly using comparative market research. Arrange structural contingencies surrounding inspection, finance, and appraisal to ensure buyer protection is upheld through closing. Utilizing verified estimates and equivalent repair costs, negotiate repairs, credits, or price changes. Expedite title clearance by coordinating with the title company and lender to resolve outstanding issues. Line-by-line review of closing statement to verify costs, prorations, and required funds. Organize post-closing logistics, including key handover, utility transfer, insurance, and tenant notifications.

Save records of agreements, modifications, and correspondence for prospective audits and legal defense. Verify that the insurance policy names, effective dates, and coverage limitations satisfy the lender's needs sufficiently. Verify final funding conditions, wire instructions, and recording timetable with the closing agent. Immediately. Following the closing, initiate a transition plan to hand over management responsibilities and welcome residents.

Develop a clear rental criteria policy that explicitly complements fair housing regulations. Consistently document photo identification, credit report, income verification, and prior landlord recommendations. Establish realistic income-to-rent ratios and thoroughly check employment and consistent income sources ahead. Where permitted, run criminal background checks; comply with local laws on acceptable information. Offset screening expenses using an application fee and record the policy for the fee.

Compose a lease detailing maintenance duties, late fees, rent arrangements, and notice requirements. It is better to require a security deposit and documentation of the move-in condition, including images, to prevent future disputes. To keep occupants informed and satisfied, clearly describe the maintenance request processes and expectations for responses. It is important to safeguard legal protections and equitable treatment for renters and adhere to lease conditions persistently. Written decisions and denial documents to demonstrate compliance with rules for nondiscrimination screening.

Depending on size and ability, choose self-management or paid professional management. Monitor your property’s financial performance every month and compare results with pro forma projections to make necessary adjustments for profitability. Invest in preventative upkeep to keep renters happy and lower total repair expenses over time. Plan capital enhancements carefully to boost net operating income and enhance assets by reevaluating rent annually against market comparables and applying raises in line with local demand value.

Effectively manage maintenance budgets every year by nurturing vendor relationships and negotiating service contracts. Watch tax plans and consult an accountant to maximize deductions and defer taxes. For unexpected expenses, compile an emergency reserve that covers several months of operational costs. Regularly assess refinancing when rates drop to reduce payments or hasten portfolio expansion. To maximize investor profits, establish exit strategies that include holding, 1031 exchange, refinancing, or sale.

Purchasing a rental property requires thorough research, strict underwriting, and realistic expectations about returns regularly. To mitigate risk, follow a systematic approach for market analysis, funding, due diligence, and tenant selection. Maintain reserves and develop conservative financial models to manage unanticipated repairs and periods of vacancy effectively. Support effective operations and growth plans by building trusted connections with bankers, contractors, and managers. Regularly evaluate performance and be ready to modify management, capital plans, or rent as needed. Rental investing can create long-term riches and consistent, dependable cash flow with patience and preparation.

TOP

TOP

Discover the key differences between Pilates and Yoga to choose the best path for your wellness.

TOP

TOP

Learn the hidden risks of silent heart disease and how to protect your heart health.

TOP

TOP

Optimize cycling comfort and performance with expert foot care and proper shoe choices.

TOP

TOP

Discover the top 5 travel goals to achieve in 2025 and ignite your wanderlust with must-visit destinations and unforgettable experiences worldwide.

TOP

TOP

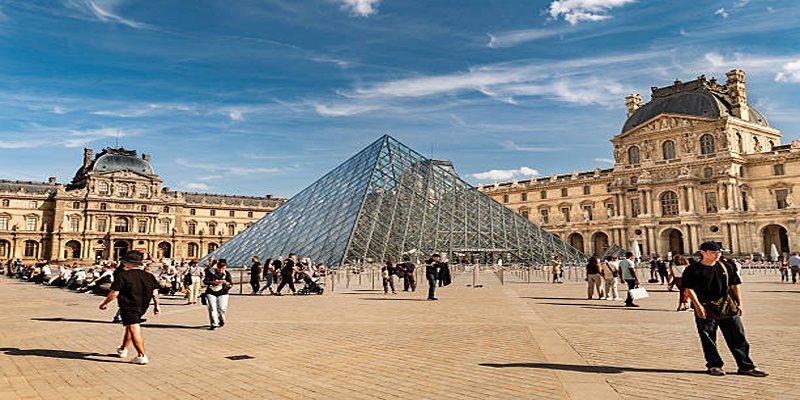

Discover Paris beyond the usual landmarks with unique attractions and hidden gems that reveal the city's authentic charm.

TOP

TOP

Oman’s Grand Canyon, a breathtaking destination offering stunning views, cultural insights, and adventurous hiking trails.

TOP

TOP

How Macumba blends ancient traditions and innovation at La Route du Rock, offering transformative musical experiences that unite and inspire.

TOP

TOP

Learn key facts about pediatric craniofacial surgery, common conditions, procedures, recovery, and emotional support that improve children’s health outcomes.

TOP

TOP

Explore how eczema increases the risk of asthma and allergies, key risk factors, immune dysfunction, and management strategies for better health.

TOP

TOP

Oman’s breathtaking coastal hiking trails, blending stunning nature and rich culture. Plan your perfect adventure today!

TOP

TOP

Learn what a promissory note in real estate is, how it works, its importance, and how it differs from a mortgage in detail here

TOP

TOP

Discover how hormones affect acne, dryness, and skin health, and learn practical tips to restore balance naturally.