Homeowners may modify their mortgage to new conditions by way of refinancing. Many people think of refinancing to lower their monthly payments and interest rates. At the same time, others want to reduce the loan period and accelerate equity construction through refinancing. Moreover, refinancing can liberate home equity for debt consolidation or repairs. Costs include appraisal costs, closing fees, and perhaps penalties for early payment.

Knowing rates, charges, and break-even time determines if refinancing is suitable. Eligibility and the interest rate given depend on income and credit scores. Better opportunities to locate savings come from comparing loan types and lenders. Set up pre-approval procedures and documentation to speed processing and minimize unexpected events. Before signing any loan contract, read carefully and ask questions. Shop rates frequently reflect market changes and enable more advantageous agreements.

Refinancing a mortgage is replacing a current home loan with a new one. The new loan often has a cheaper interest rate or better terms. People redo their mortgages either to save money or to better their terms. When market interest rates fall, homeowners frequently opt to refinance. Additionally, they refinance to alter the loan term for quicker payoff. If necessary, refinancing can also provide funds through a cash-out option.

Under different terms, the lender pays off the existing mortgage and initiates a new one. Paperwork and credit checks are part of the process, much as when you apply for a new mortgage. Knowing this idea enables borrowers to make informed decisions. Refinancing can either streamline payments or provide more flexibility in financial management over time.

For several major reasons that advance their financial objectives, homeowners refinance. Reducing the interest rate for smaller payments is a primary reason. Another factor is stability gained from switching the mortgage to a fixed-rate one. Refinancing can also speed up the mortgage and shorten the loan period. Many people rewrite to combine debt and streamline monthly bills.

Some use cash-out refinancing to get house equity for major expenditures. Most homeowners choose refinancing for financial security and to reduce costs. Lower monthly payments might free up funds for other financial demands. Better conditions provide stability for the future and lower long-term interest payments. Knowing these factors enables borrowers to assess whether refinancing aligns with their current objectives.

Comparing lenders and their proposed terms starts the refinancing process. Borrowers request that the lender consider their application. Before authorization, lenders review credit score, income, and home equity. Typically, an appraisal is required to determine the property's value. Following approval, the existing mortgage will be paid using the new loan amount.

Carefully consider the closing costs and fees that comprise the refinancing process. Then the borrower begins payments under the modified conditions. The steps for verification and paperwork are almost the same as a typical mortgage application procedure. Depending on bank standards, completing the whole process might take several weeks. Knowing every stage enables homeowners to prepare ahead of time and avoid unnecessary delays during the refinancing process.

Borrowers have expenses associated with mortgage refinance that they must arrange for ahead of time. One of the biggest charges associated with refinancing is closing costs. These costs include valuation fees, title fees, and other expenses levied by the lender. Rates can be slightly higher when some lenders provide no-closing-cost refinancing. If borrowers' present loan has such conditions, they may additionally incur prepayment penalties. Over time, it is wise to compute if the savings exceed the expenses.

Finding the most reasonable refinancing arrangement requires comparing several lenders. Some creditors add fees to the fresh loan balance, hence raising the total payback. Refinancing also makes sense if your house has increased in value, as it provides funds for debt reduction or home improvement projects. One would be wise to switch from an adjustable-rate to a fixed-rate mortgage for stability. One can maximize the financial return without unnecessary risk or additional costs by carefully evaluating these conditions through refinancing.

The ideal time to refinance a mortgage depends on several major elements that can maximize financial gain. Most homeowners decide to refinance when interest rates are significantly lower than their existing rate. A drop of even one percentage point can lead to significant long-term savings. Better credit scores also present a perfect opportunity, as higher ratings usually ensure more favorable loan conditions and lower expenses.

If your home has increased in value, it makes sense to refinance, as it provides funds for debt payment or for home expansion projects. For stability, it is advisable to opt for a fixed-rate mortgage rather than an adjustable-rate mortgage. By thoroughly assessing these circumstances, one can ensure the most financial benefit without incurring needless risk or additional expenditures through refinancing.

Several types of refinancing are available to meet various homeowner goals and needs. Most often used for rate reductions or loan length adjustments is rate-and-term refinancing. Homeowners can access equity for significant expenditures through cash-out refinancing. Paying additional toward the principal to lower the loan balance is known as cash-in refinancing. Government-backed mortgages, such as FHA or VA, can be streamlined refinancing.

With fewer papers and lower expenses, the process is simpler. Every type has its particular advantages and disadvantages that borrowers should be aware of before making a selection. Understanding these choices helps choose the right one for financial objectives. Individual needs and present loan conditions determine the best refinancing type. Careful selection ensures that the refinance offers homeowners the most benefit.

Refinancing a home mortgage can both reduce the interest paid over the loan term and lower installments. Homeowners refinance when they desire steady payments and financial stability or when interest rates fall. Determine the break-even point to determine how long it will take to recoup the refinancing fees. Often, securing better loan offers and lower rates requires improving credit scores and increasing home equity. Select either shorter terms to clear debts more quickly or longer terms to have lower monthly payback. Transparent planning and thorough lender comparison help establish whether refinancing aligns with long-term objectives.

TOP

TOP

Discover the key differences between Pilates and Yoga to choose the best path for your wellness.

TOP

TOP

Learn the hidden risks of silent heart disease and how to protect your heart health.

TOP

TOP

Optimize cycling comfort and performance with expert foot care and proper shoe choices.

TOP

TOP

Discover the top 5 travel goals to achieve in 2025 and ignite your wanderlust with must-visit destinations and unforgettable experiences worldwide.

TOP

TOP

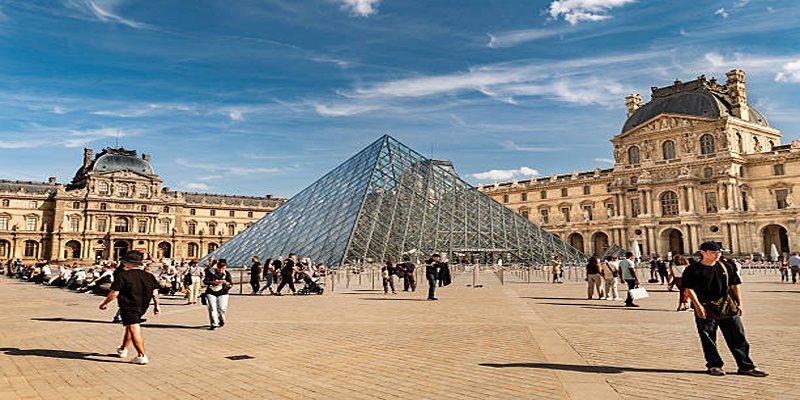

Discover Paris beyond the usual landmarks with unique attractions and hidden gems that reveal the city's authentic charm.

TOP

TOP

Oman’s Grand Canyon, a breathtaking destination offering stunning views, cultural insights, and adventurous hiking trails.

TOP

TOP

How Macumba blends ancient traditions and innovation at La Route du Rock, offering transformative musical experiences that unite and inspire.

TOP

TOP

Learn key facts about pediatric craniofacial surgery, common conditions, procedures, recovery, and emotional support that improve children’s health outcomes.

TOP

TOP

Explore how eczema increases the risk of asthma and allergies, key risk factors, immune dysfunction, and management strategies for better health.

TOP

TOP

Oman’s breathtaking coastal hiking trails, blending stunning nature and rich culture. Plan your perfect adventure today!

TOP

TOP

Learn what a promissory note in real estate is, how it works, its importance, and how it differs from a mortgage in detail here

TOP

TOP

Discover how hormones affect acne, dryness, and skin health, and learn practical tips to restore balance naturally.