If it's your first time, getting a credit card can initially seem difficult. Many individuals worry about rejection or not knowing what they should be doing. Actually, if you know what to do, the procedure can be simple. A credit card can do more than pay; it can also help you build credit, monitor your spending, and even get rewards.

If you use them properly, such as receiving travel privileges or money back, the rewards can be amazing. But banks carefully evaluate applicants, hence one must be ready. Knowing which papers you require, which card to choose, and how to improve your chances of getting accepted will simplify the process. Following the easy instructions in this guide will enable you to obtain a credit card.

Here are the easy steps, broken down in a way that makes them easier for first-timers to understand.

A credit card is a way to borrow money to buy things and pay bills. You pay it back later, just like you would with a short-term loan. A lot of people use credit cards to pay for things they need every day, in an emergency, or when they vacation. The best thing about it is that it helps you create a good credit history. This record will make it easier for you to obtain loans in the future. Credit cards also offer perks like cash back, discounts, and points for rewards. However, using it incorrectly can lead to a significant amount of debt.

You need to ensure you qualify before applying for a credit card. Banks and other financial institutions look over applicants very carefully. They take into account essential things, including age, income, and credit history. Most banks won't let you apply unless you're at least 18 years old. A regular income demonstrates that you can repay borrowed money on time and in full. A solid credit score significantly boosts your acceptance prospects. Individuals new to credit and without a credit history may consider student or secured credit cards as a way to establish a credit history.

There are numerous credit cards available, each with its own pros and cons, pricing, and benefits. Your lifestyle and spending habits will help you choose the right one. Some cards give you cash back on groceries, bills, or shopping, while others give you points for vacation. People who travel frequently can find cards that offer them flight miles and hotel savings to be useful. At the same time, other customers may prefer cards that offer cash back. Comparing annual fees, interest rates, and credit limitations is very significant.

To apply for a credit card, you need to show certain documentation that proves who you are, where you live, and how much money you have. A passport or ID card is a common document that verifies your identity. Like utility bills or a rental agreement, you will also need proof of your current residence. Pay stubs or bank statements are further evidence of income you need. Having these documents ready will help the application process run smoothly and without any issues.

You can apply for a credit card either online or in person, depending on your preference. It's easy and quick to apply online. You fill out a form, upload files, and send them in a few minutes. Some banks even offer fast approval online. You must visit a bank branch in person to apply for offline services. You give your form and papers immediately to a bank employee. This option is great if you need help or have questions.

Banks are cautious when accepting credit cards, but you can take steps to increase your chances of success. Before you apply, verify your credit score. Higher scores receive approvals faster. To raise your score, pay your payments on time and pay off any debts you already have. Second, apply for cards that fit your income and profile. People who are just starting should get basic or student cards and then upgrade later. Third, avoid applying for too many cards at once, as it may appear that you are desperate.

The bank initiates the approval process when you submit your application. They review your credit history, income, and employment history. It could take a few days or longer for this review to be done. If the bank approves your application, you will receive a card in the mail. A few banks also offer a virtual card that you can use immediately. You also receive information about the terms, conditions, and fees associated with your card. If the bank turns you down, they will provide a reason, such as a low credit score or insufficient income. You can reapply after meeting the requirements.

You cannot use your card until it is activated. The card pack includes bank instructions. Activation of your account can be done via ATM, phone call, or the internet. Once you turn the card on, you can use it to buy goods and services. Always spend sensibly and within your financial reach. Timely bill payment helps maintain a high credit score and prevents late penalties. Pay the entire amount, not only the bare minimum. Responsible use of credit helps establish good credit, which in turn enables you to access superior credit cards.

Obtaining a credit card should not cause stress or difficulty. You can apply with assurance if you know what to do. First, see if you qualify; then, examine card options and have your documents ready. Select whether to apply in person or online, and then wait for the approval process to be completed. Turn your card on and operate it correctly once it is approved. Pay your bills on time, avoid overspending, and strive to create a strong credit history. Enjoy the benefits of prudent decisions free from financial concern.

TOP

TOP

Discover the key differences between Pilates and Yoga to choose the best path for your wellness.

TOP

TOP

Learn the hidden risks of silent heart disease and how to protect your heart health.

TOP

TOP

Optimize cycling comfort and performance with expert foot care and proper shoe choices.

TOP

TOP

Discover the top 5 travel goals to achieve in 2025 and ignite your wanderlust with must-visit destinations and unforgettable experiences worldwide.

TOP

TOP

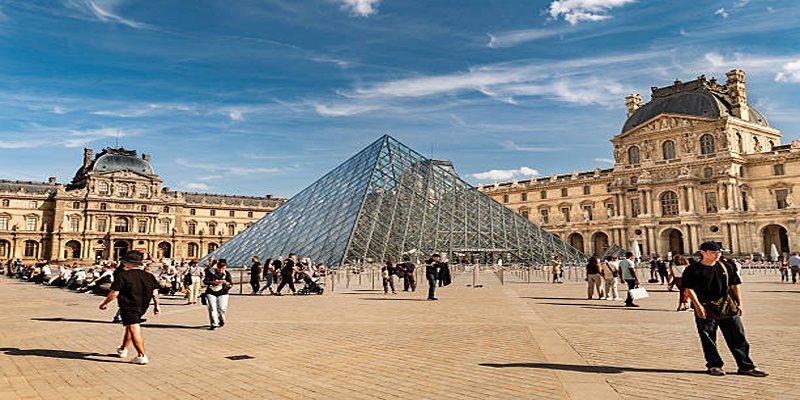

Discover Paris beyond the usual landmarks with unique attractions and hidden gems that reveal the city's authentic charm.

TOP

TOP

Oman’s Grand Canyon, a breathtaking destination offering stunning views, cultural insights, and adventurous hiking trails.

TOP

TOP

How Macumba blends ancient traditions and innovation at La Route du Rock, offering transformative musical experiences that unite and inspire.

TOP

TOP

Learn key facts about pediatric craniofacial surgery, common conditions, procedures, recovery, and emotional support that improve children’s health outcomes.

TOP

TOP

Explore how eczema increases the risk of asthma and allergies, key risk factors, immune dysfunction, and management strategies for better health.

TOP

TOP

Oman’s breathtaking coastal hiking trails, blending stunning nature and rich culture. Plan your perfect adventure today!

TOP

TOP

Learn what a promissory note in real estate is, how it works, its importance, and how it differs from a mortgage in detail here

TOP

TOP

Discover how hormones affect acne, dryness, and skin health, and learn practical tips to restore balance naturally.