Understanding a pay stub is essential for effective income management and financial planning. Each pay stub provides a detailed salary breakdown, including earnings and deductions. It explains how taxes, benefits, and other contributions affect your take-home pay. Reviewing these details helps identify errors and confirm accurate payments. It also shows how much goes toward health insurance, retirement, and other deductions.

Employers issue pay stubs for legal compliance and to maintain transparency with employees. Regularly checking this document helps avoid mistakes and improve budgeting decisions. Accurate knowledge of gross income, net pay, and deductions supports better financial control. Anyone who receives a paycheck can benefit from learning to read it, ensuring smarter money management and greater confidence in handling finances.

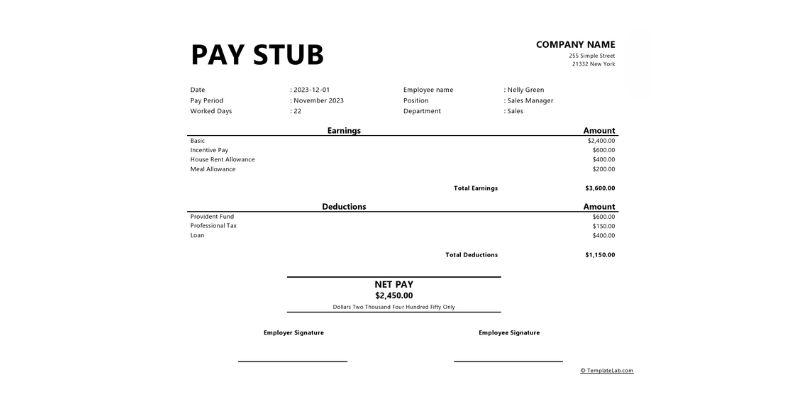

Personal and business details appear at the top of a paycheck, including the employee's name, address, and the company name. The section also clearly indicates the payment date and pay period. Employees should always review this information to verify its accuracy. The pay period reveals the range of dates under consideration; the pay date specifies the date the cheque is given.

Errors in these specifics can cause tax problems or payment delays later on. Some stubs also feature an employee ID for internal records, therefore ensuring accurate identification. Checking names, addresses, and dates against your records is crucial to prevent errors. Early detection of mistakes helps prevent missed benefits or incorrect tax filings. Good basic data shields against unnecessary problems and ensures quick payroll processing.

Gross compensation represents the total amount earned before any deductions or adjustments. It includes regular wages for hours worked, as well as overtime, bonuses, and any other additional income earned during the pay period. Unlike net pay, gross pay does not account for taxes, insurance, or other withholdings, making it the highest figure on your paycheck.

This amount serves as the basis for all subsequent calculations, so accuracy is crucial. Most pay stubs display gross pay near the top, often separated into current period and year-to-date totals. Understanding this number helps you estimate your take-home pay and track total earnings over time. Always confirm that your gross pay matches your pay rate and hours worked. Errors in this figure can affect all other calculations, including taxes and deductions.

Among the most significant deductions on a pay stub are taxes. Federal income tax is usually the highest, followed by state tax if applicable. Local taxes are also included on the earnings statement in certain regions. Most employees are required to pay contributions for Social Security and Medicare, also known as FICA levies, which are listed under deductions.

The amount withheld varies depending on your income level and the details given on your tax forms. Checking these deductions ensures accuracy and helps prevent unexpected issues during tax season. Penalties can arise from underpayment; overpayment lowers your disposable income until refunds are paid. For clarity, pay stubs typically specify each type of tax separately. To prevent compliance problems and financial hazards later, always check that these sums correspond with your filing status and income.

Many workers opt for voluntary deductions for retirement plans or benefits, which appear on the pay stub after compulsory taxes. Common examples include health insurance, dental coverage, and retirement contributions. Some workers also have deductions for commuter benefits, life or disability insurance, or flexible spending accounts. Often, these deductions decrease taxable income, providing possible year-round savings.

Regular verification maintains accuracy and prevents errors in your records. Benefit costs may vary over time; therefore, continuous validation is essential. Usually, pay stubs for these deductions display both year-to-date and current amounts. Always confirm that the amounts match your enrollment choices to prevent coverage problems. Mistakes in these computations could influence retirement objectives or benefits. Knowing them enables you to manage your entire salary effectively.

Net pay is the amount you take home after all taxes and deductions are applied. Usually found at the bottom of your paycheck, it denotes either the direct deposit amount or the amount of the check you receive. Net income equals gross pay minus mandatory and voluntary deductions. This number is very important, as it reflects your actual spending power.

Comparing gross pay to net pay clarifies how taxes and benefits affect income. It helps one to plan and control monthly costs precisely. Review your pay stub each period to ensure the final amount accurately reflects your agreed-upon salary. Deductions must be accurate, as errors can reduce your net pay. Since overtime, bonuses, and benefit changes can affect your income, so it's essential to monitor your pay regularly to maintain financial stability.

Year-to-date (YTD) information provides an overview of your total income and deductions from the start of the year. It helps employees monitor income growth by including cumulative gross pay, taxes, and benefit contributions. Reviewing YTD numbers helps with tax planning and cost control by highlighting your earnings and contributions. These figures help you determine if taxes and rewards align with your expectations.

Detecting discrepancies early prevents issues that can build over time. Some pay stubs also include employer payments for benefits and other information, such as overtime or leave balances. A thorough reading of these parts ensures total comprehension and accurate record-keeping. Keeping pay stubs with YTD information helps with loan applications and tax preparation. Effective financial planning and upkeep of income control depend on precise YTD numbers.

Reading a pay stub carefully enables you to clearly understand your earnings and deductions. For all employees, it's a basic habit. A personal budget depends on taxes, benefits, and the final pay shown on pay stubs. Verifying them ensures correct withholdings and prevents payment errors. Since errors can occur, financial stability depends on carefully inspecting the specifics. Tax preparation and yearly income monitoring also benefit from pay stubs. Employees who understand their pay stubs feel confident and in control of their finances. Knowing these facts now makes managing money easier and less stressful.

TOP

TOP

Discover the key differences between Pilates and Yoga to choose the best path for your wellness.

TOP

TOP

Learn the hidden risks of silent heart disease and how to protect your heart health.

TOP

TOP

Optimize cycling comfort and performance with expert foot care and proper shoe choices.

TOP

TOP

Discover the top 5 travel goals to achieve in 2025 and ignite your wanderlust with must-visit destinations and unforgettable experiences worldwide.

TOP

TOP

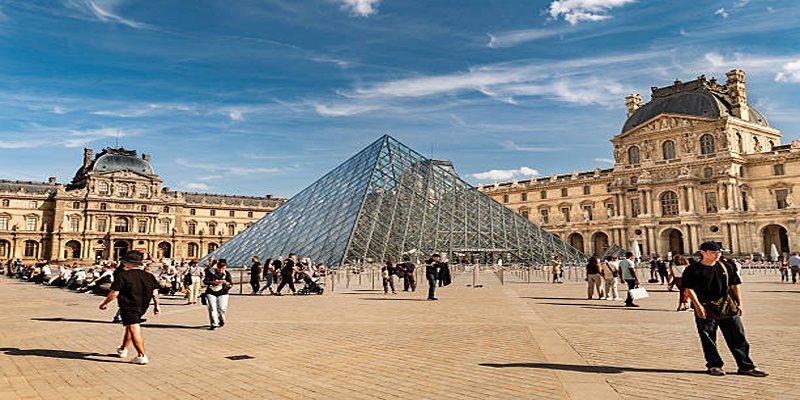

Discover Paris beyond the usual landmarks with unique attractions and hidden gems that reveal the city's authentic charm.

TOP

TOP

Oman’s Grand Canyon, a breathtaking destination offering stunning views, cultural insights, and adventurous hiking trails.

TOP

TOP

How Macumba blends ancient traditions and innovation at La Route du Rock, offering transformative musical experiences that unite and inspire.

TOP

TOP

Learn key facts about pediatric craniofacial surgery, common conditions, procedures, recovery, and emotional support that improve children’s health outcomes.

TOP

TOP

Explore how eczema increases the risk of asthma and allergies, key risk factors, immune dysfunction, and management strategies for better health.

TOP

TOP

Oman’s breathtaking coastal hiking trails, blending stunning nature and rich culture. Plan your perfect adventure today!

TOP

TOP

Learn what a promissory note in real estate is, how it works, its importance, and how it differs from a mortgage in detail here

TOP

TOP

Discover how hormones affect acne, dryness, and skin health, and learn practical tips to restore balance naturally.