American financial life now depends heavily on credit ratings. Whether you are looking for a vehicle loan, a mortgage, or even a rental property, your score is quite important. More people are concerned about their credit health in 2025 as borrowing rates and the cost of living continue to increase. In America, the average credit score paints a quite clear picture of how effectively people are managing money all around the country.

It also reveals how shifting financial trends, personal behaviors, and economic forces affect people. Knowing these figures guides you in contrasting your performance and enables wise financial decisions. This article looks at the present average, why credit scores count, what influences them, and how you may create greater financial stability in the future.

The average credit score in the United States is now about 717. It is expected to be in 2025. Considering more recent issues, including inflation and growing living expenses, this figure points to a reasonably strong state of affairs for the country's finances. A score above 700 is considered excellent, indicating that most Americans are handling their financial commitments carefully. This average also reveals that even with high interest rates, consumers are maintaining on-time payments and staying clear of excessive debt loads.

The average, meanwhile, does not depict every person equally. Shorter credit histories and more student or credit card debt lead many younger individuals to fall below this figure. Older generations, on the other hand, typically show scores better than the national average since they have longer credit histories and always pay on time. The 717 average points to stability as it shows that people are adjusting to economic hardships and still striving to keep good credit behavior. It demonstrates awareness and fortitude in handling credit and loans prudently.

Several key factors influence the national average credit score in America. Payment history is the first and biggest thing that counts. Consistent on-time payments boost grades; missing or late payments might lead to steep drops. Credit utilization—or the degree to which you use your accessible credit—is yet another important component. For optimal results, professionals advise maintaining utilization under 30%. The duration of the credit history also counts, as longer histories show consistency.

Having a range of credit types, such as loans and credit cards, will also help raise grades. Also, making too many accounts at once or opening too many new credit inquiries can lower your score for a short time. Beyond these, more general financial factors, including unemployment rates and inflation, help to determine national averages. Financial hardship frequently causes people to miss payments or have greater balances, therefore affecting their scores. These elements taken together help define nationally each year whether averages climb or drop.

Credit scores in the US vary significantly due to differences in the economy at the state and regional levels. In many Midwestern states, the averages are higher since people there tend to have less debt and make their payments on time. On the other hand, several southern states report lower scores because they have higher rates of medical debt, lower average incomes, and fewer financial resources in some areas. California and New York are two coastal states that have mixed results.

Living costs are higher, which means more debt, but they also have better access to financial tools that help people manage their credit. Rural places may have problems since they don't have easy access to traditional banking services. Urban areas, on the other hand, often have better averages because residents there tend to earn more money and have more financial options. These regional disparities show that credit health is affected by both personal habits and local economic conditions. It shows how location can affect financial stability and credit performance across the country.

Average credit scores in the United States are greatly affected by economic developments. Many families struggle to manage growing expenses when the economy is under pressure or inflation is high. It complicates bill payment and frequently lowers credit scores. Conversely, more individuals may pay off debts on time when wages increase and the economy is robust, therefore raising national averages. Interest rates are also important. Higher rates increase the cost of borrowing, which may lead to missed payments or reduced credit availability.

Government regulations and relief efforts can also temporarily safeguard hundreds of people. Pausing student loan payments during difficult situations, for instance, helped avoid score drops. The average score remains consistent at 717 in 2025, even as the economy shows signs of recovery following years of financial difficulties. This consistency shows how resilient Americans are by showing how they are adapting to demands and yet discovering solutions to keep good credit behavior.

Since they represent different financial phases in life, credit ratings in the United States differ noticeably across age groups. Younger adults, especially those under 30, frequently score below 650 to 680. They may have student loans or additional credit card debt and are only beginning to establish their credit histories. Typically, middle-aged people tend to have higher averages—sometimes between 710 and 730.

Typically juggling multiple accounts, such as mortgages, car loans, and credit cards, this group has more established credit. Older individuals—especially those over 60—typically score the best, occasionally achieving scores above 740. Longer histories, regular payments, and less past-due debt help them flourish. These variations highlight the impact of experience and time on credit construction. Younger generations can still improve their scores by paying bills on time and avoiding high debt.

The average credit score in America in 2025 shows both financial responsibility and resilience. It reveals that, at 717, many individuals are handling debt sensibly despite rising costs of living and inflation. Still, depending on age, location, and financial practices, results vary significantly. Knowing the elements influencing these figures can assist you in spotting strategies to raise your personal rating. Paying bills on time, limiting debt, and developing a long credit history will help you improve your financial situation.

TOP

TOP

Discover the key differences between Pilates and Yoga to choose the best path for your wellness.

TOP

TOP

Learn the hidden risks of silent heart disease and how to protect your heart health.

TOP

TOP

Optimize cycling comfort and performance with expert foot care and proper shoe choices.

TOP

TOP

Discover the top 5 travel goals to achieve in 2025 and ignite your wanderlust with must-visit destinations and unforgettable experiences worldwide.

TOP

TOP

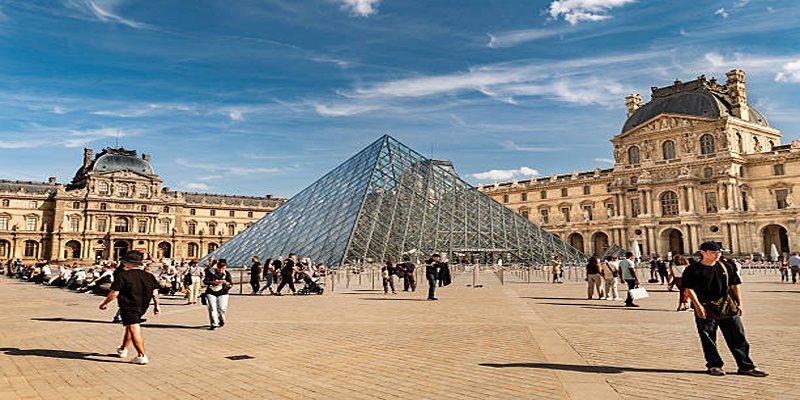

Discover Paris beyond the usual landmarks with unique attractions and hidden gems that reveal the city's authentic charm.

TOP

TOP

Oman’s Grand Canyon, a breathtaking destination offering stunning views, cultural insights, and adventurous hiking trails.

TOP

TOP

How Macumba blends ancient traditions and innovation at La Route du Rock, offering transformative musical experiences that unite and inspire.

TOP

TOP

Learn key facts about pediatric craniofacial surgery, common conditions, procedures, recovery, and emotional support that improve children’s health outcomes.

TOP

TOP

Explore how eczema increases the risk of asthma and allergies, key risk factors, immune dysfunction, and management strategies for better health.

TOP

TOP

Oman’s breathtaking coastal hiking trails, blending stunning nature and rich culture. Plan your perfect adventure today!

TOP

TOP

Learn what a promissory note in real estate is, how it works, its importance, and how it differs from a mortgage in detail here

TOP

TOP

Discover how hormones affect acne, dryness, and skin health, and learn practical tips to restore balance naturally.